Navigating Solitude: How 'Bill' Empowers Your 'Home Alone' Finances

In an increasingly digital world, the concept of being "home alone" has evolved far beyond a classic movie trope. For many, it now signifies the reality of managing a small business, freelancing, or handling personal finances from the quiet confines of their own space. This independent journey, while empowering, often comes with a unique set of challenges, particularly when it comes to financial operations. The sheer volume of invoices, payments, expenses, and bookkeeping tasks can quickly become overwhelming, making the dream of autonomy feel more like a burden. This is where the innovative financial platform, Bill, steps in, offering a robust suite of tools designed to simplify complex financial processes for those navigating their economic landscape solo. By automating crucial tasks and providing comprehensive oversight, Bill transforms the daunting "bill erwin home alone" scenario into one of streamlined efficiency and control.

- Brian And Mika

- Penelope Cruz Parents

- Julia Louis Dreyfus Soles

- Lorne Greene Of Bonanza

- How Old Is Robin Roberts Wife

Whether you're a burgeoning entrepreneur, a seasoned freelancer, or simply someone seeking to bring order to your personal financial life, the need for reliable, intuitive, and secure financial management tools is paramount. The modern "home alone" professional requires solutions that not only automate tedious tasks but also provide clarity, security, and peace of mind. Bill is engineered precisely for this purpose, offering a unified platform where payments, expenses, and cash flow are managed with unparalleled ease. It's about empowering individuals and small firms to focus on what they do best, rather than getting bogged down by administrative minutiae.

Table of Contents

- The Modern "Bill Erwin Home Alone" Scenario: Beyond the Silver Screen

- Automating the Core: Accounts Payable and Receivable with Bill

- Mastering Spend & Expense Management: When You're Your Own CFO

- The Human Touch in Automation: Bill's Robust Support System

- Overcoming Digital Hurdles: The Need for Clarity in Financial Transactions

- Expanding Horizons: How Bill Grows Your Firm's Opportunities

- The Trust Factor: Why E-E-A-T and YMYL Matter for Your "Home Alone" Finances

- Getting Started: Your First Step Towards Financial Independence

The Modern "Bill Erwin Home Alone" Scenario: Beyond the Silver Screen

The phrase "Bill Erwin Home Alone" might conjure images of a lone figure navigating challenges, much like the iconic movie. However, in the context of modern finance, it speaks to the independent professional, the small business owner, or the individual managing their financial world without a dedicated accounting department or a large support team. This isn't about being literally isolated, but about taking sole responsibility for financial health. In this scenario, efficiency, accuracy, and security are not just desirable; they are absolutely essential. The stakes are high, as every transaction, every payment, and every expense directly impacts personal livelihood or business viability.

For these individuals, the traditional methods of paper invoices, manual reconciliation, and fragmented payment systems can quickly lead to errors, missed deadlines, and significant stress. The challenge isn't merely about processing transactions; it's about gaining a clear, real-time understanding of cash flow, managing vendor relationships, ensuring timely payments, and getting paid promptly. It's about having the tools to confidently navigate the financial landscape, even when you're the only one at the helm. This is precisely the void that a platform like Bill fills, transforming potential chaos into structured control.

- Pinks Daughter Willow Age

- Season 14 Greys Anatomy Interns

- Brad Pitt Children

- Bob Barker Retired

- Michael J Fox Brother

Automating the Core: Accounts Payable and Receivable with Bill

At the heart of any financial operation, especially for those operating in a "bill erwin home alone" capacity, are accounts payable (AP) and accounts receivable (AR). These two pillars dictate how money flows in and out of your business or personal accounts. Without efficient systems, managing these can be a monumental task, consuming valuable time and energy that could be better spent on core activities. Bill addresses this head-on by providing comprehensive automation for both.

For accounts payable, Bill offers the best accounts payable software designed to automate your entire process. Imagine no longer manually entering invoices or chasing down approvals. With Bill, you can pay your business invoices online, streamlining what was once a cumbersome, error-prone task. This automation extends beyond mere payment; it encompasses the entire workflow, from receiving bills to their final settlement. This not only saves time but also significantly reduces the risk of late payments, penalties, and strained vendor relationships. To truly understand the depth of this transformation, one can learn more about AP automation with Bill, delving into features that bring unparalleled efficiency.

On the flip side, getting paid quickly and reliably is just as critical. Bill's accounts receivable software is a game-changer for those who are often "home alone" in their billing efforts. It simplifies the entire process for all small businesses with digital invoices and electronic payments. This means you can get paid up to 2x faster, a crucial advantage for cash flow management. The flexibility to choose ACH and credit card to receive payment further enhances convenience for your clients, removing barriers to prompt payment. Whether you're focused on paying or getting paid, Bill simplifies the entire process, ensuring that your financial operations run smoothly and efficiently, even without a dedicated finance department.

Mastering Spend & Expense Management: When You're Your Own CFO

Beyond just paying and getting paid, effective financial management for the "bill erwin home alone" professional requires meticulous control over spending and expenses. Every dollar counts, and understanding where money is going is vital for budgeting, forecasting, and strategic decision-making. Bill expands opportunities for your firm by offering robust spend and expense management services. This isn't just about tracking; it's about gaining granular control and visibility.

The platform allows you to automate bookkeeping tasks, ensuring that every expense is categorized and recorded accurately, without the need for tedious manual entry. This level of automation is particularly beneficial for individuals who wear multiple hats, as it frees up valuable time while maintaining financial integrity. To facilitate this, Bill provides easy access to its features, allowing users to learn how to log in to Bill Spend & Expense on a web browser or the Bill Spend & Expense mobile app. This flexibility ensures that you can manage your finances on the go, whether you're at your desk or away from it. Furthermore, if your spend & expense account is integrated with other systems, Bill ensures a seamless flow of data, providing a unified financial picture. This integrated approach is critical for maintaining accurate records and making informed financial decisions, empowering you to truly act as your own CFO.

The Human Touch in Automation: Bill's Robust Support System

While automation is key, even the most sophisticated systems require human support, especially when dealing with the intricacies of finance. For the "bill erwin home alone" user, knowing that help is readily available can be a significant source of comfort and trust. Bill understands this need and provides a comprehensive support system that ensures users are never truly alone in their financial journey.

Bill offers live support from 5 am to 6 pm PT, Monday through Friday, and from 6 am to 3 pm PT, Saturday and Sunday, excluding holidays. This extensive availability ensures that help is often just a call or click away, covering most working hours across different time zones. For immediate assistance or to find answers to common questions, the quickest way to get support is to visit the Bill Help Center. This self-service portal is a treasure trove of information, guides, and troubleshooting tips. Users can access the help center by selecting "Help Center" in the navigation menu or "Support" at the bottom of the page, making it incredibly easy to find the information they need without delay. This commitment to accessible and responsive support reinforces Bill's trustworthiness and expertise, crucial elements for any YMYL (Your Money or Your Life) service.

Overcoming Digital Hurdles: The Need for Clarity in Financial Transactions

In the digital age, financial transactions, while convenient, can sometimes be fraught with complexities and frustrations. For the "bill erwin home alone" individual, these issues can be particularly vexing, as there's often no dedicated team to untangle them. The provided data highlights several common pain points that underscore the need for the clarity and control that Bill aims to provide.

Decoding Confusing Charges: A Common "Home Alone" Financial Frustration

One significant area of frustration stems from unclear billing practices. Users often report that companies "bill people early for subscription renewals" or even "bill people multiple times for the same subscription." To compound the problem, "the descriptions for the charges are useless, unintelligible," leaving individuals bewildered and unsure of what they've actually paid for. This lack of transparency can lead to significant financial stress, wasted time investigating discrepancies, and even disputes. Bill's system, with its clear digital invoices and centralized expense management, directly addresses these issues by providing a single, verifiable source of truth for all transactions. By automating and categorizing expenses, it makes it far easier to identify and challenge erroneous or confusing charges, offering peace of mind to those managing their finances independently.

Navigating Legacy Systems and Digital Challenges

Beyond direct billing issues, the digital landscape presents a myriad of other challenges that can indirectly impact financial well-being and the need for robust, modern solutions. Consider the frustrations expressed by users dealing with old Hotmail accounts filled with "important personal emails" or struggling with "product key mismatch" issues for operating systems like Windows 8.1. The sentiment of "I've been trying several things indicated in the website but no success" and "Please help as there are lots of important personal emails" speaks to a broader digital struggle where legacy systems and outdated support can lead to significant distress.

Similarly, issues like "Driversupport one is not a Microsoft product. Look for uninstall instructions at the bottom of this," or the stark reality that "Support and downloads for 8 has ended," highlight the constant need to stay updated and secure in a rapidly evolving tech environment. While these aren't directly financial transactions, they illustrate the broader digital context in which "bill erwin home alone" individuals operate. The need for reliable, up-to-date, and secure systems extends to all aspects of digital life, including financial management. Bill, as a modern, cloud-based platform, offers a stark contrast to these legacy system headaches, providing a stable and continuously updated environment for critical financial operations. It offers a secure and organized alternative to the digital chaos that can sometimes feel like harassment, as any "behavior intended to disturb or upset a person or group of people" can manifest in digital frustrations, including financial ones.

Expanding Horizons: How Bill Grows Your Firm's Opportunities

For small firms and independent professionals, the "bill erwin home alone" situation isn't just about survival; it's about growth. Bill is not merely a tool for managing existing operations; it's a catalyst for expansion. By automating core financial tasks, it frees up invaluable time that can be reinvested into strategic initiatives, client acquisition, or service development.

The platform allows firms to automate payments, manage expenses, and enhance cash flow in a single platform. This holistic approach means that financial data is always current and accessible, enabling better decision-making and more agile responses to market opportunities. When bookkeeping tasks are automated, and client bill pay is enabled, firms can focus on what truly matters: serving their customers and expanding their reach. Joining Bill means simplifying your financial operations, which in turn means more time and resources to explore new avenues, take on more clients, or develop innovative services. It transforms the administrative burden into a strategic advantage, empowering growth even when resources are limited.

The Trust Factor: Why E-E-A-T and YMYL Matter for Your "Home Alone" Finances

When you're managing your finances independently, often in a "bill erwin home alone" setup, the principles of E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness) and YMYL (Your Money or Your Life) are not just buzzwords; they are fundamental requirements for any financial tool you choose. Your financial well-being directly impacts your life, making the reliability of your financial software paramount.

Bill embodies these principles through its robust features and transparent operations. Its expertise is evident in its specialized automation for accounts payable and receivable, designed specifically for small businesses. The authority comes from its comprehensive suite of services, including spend and expense management, all integrated into a single platform. Trustworthiness is built through its reliable live support, clear communication, and commitment to simplifying complex financial processes. When you're dealing with your money, you need a system that is not only functional but also demonstrably secure and reliable. The fact that Bill simplifies digital invoices and electronic payments, and offers live support, contributes significantly to its E-E-A-T profile, making it a dependable choice for managing your critical financial operations. The clear descriptions of charges, the ability to track every dollar, and the accessibility of support all contribute to a trustworthy environment, crucial for YMYL topics.

Getting Started: Your First Step Towards Financial Independence

The journey to financial independence and streamlined operations, especially for those in a "bill erwin home alone" scenario, begins with a single step. Bill makes this step easy and accessible. You can sign up for a trial to get started, allowing you to explore the platform's capabilities and see firsthand how it can transform your financial management. This low-risk entry point is ideal for individuals and small businesses who want to evaluate the benefits before making a full commitment.

Accessing Support: Beyond the Initial Setup

Even after the initial setup, continuous access to support and resources is vital. As mentioned, Bill offers extensive live support hours and a comprehensive Help Center. This ongoing support ensures that as your financial needs evolve or new questions arise, you have a reliable resource to turn to. It's about building a long-term partnership with a financial tool that grows with you, providing assistance every step of the way. Whether it's a question about integrating your spend & expense account or understanding a new feature, help is always within reach.

Staying Informed: The Digital Landscape and Your Finances

In the dynamic digital world, staying informed is key. While the "popular now" section to Microsoft's Bing search engine feature is designed to let you see daily news trends by glancing at the homepage, it also subtly reminds us of the constant flow of information and the need to stay updated. For financial management, this translates to understanding new regulations, emerging payment methods, and evolving security threats. Bill, as a platform, continuously updates its features and security protocols to meet these changing demands, ensuring that your financial operations remain secure and compliant. By providing a stable and evolving platform, Bill helps you stay ahead, even when you're managing everything from your "home alone" office.

Conclusion

The modern "bill erwin home alone" scenario, characterized by independent financial management, demands tools that are not just functional but transformative. Bill stands out as a comprehensive solution that automates the tedious, clarifies the complex, and empowers the individual. From streamlining accounts payable and receivable to mastering spend and expense management, Bill provides the robust infrastructure needed to navigate financial operations with confidence and control. Its commitment to accessible support and continuous improvement further solidifies its position as a trustworthy partner for any independent professional or small business.

By embracing platforms like Bill, individuals can reclaim valuable time, reduce stress, and focus on growth, turning the challenges of solitary financial management into opportunities for greater efficiency and success. If you're ready to simplify your financial operations, enhance cash flow, and gain unparalleled control over your money, consider signing up for a trial with Bill today. Share your experiences in the comments below – how has automation transformed your "home alone" financial journey? Your insights could help others navigate their path to financial independence.

- Barbra Streisand Husband Now

- Is Tom Jones Married

- Season 14 Greys Anatomy Interns

- Frannie And Matt Still Together

- Pat Sajak Paid Per Episode

Bill Gates Fast Facts - CNN

Bill Gates to guest on 'The Big Bang Theory' - CNN

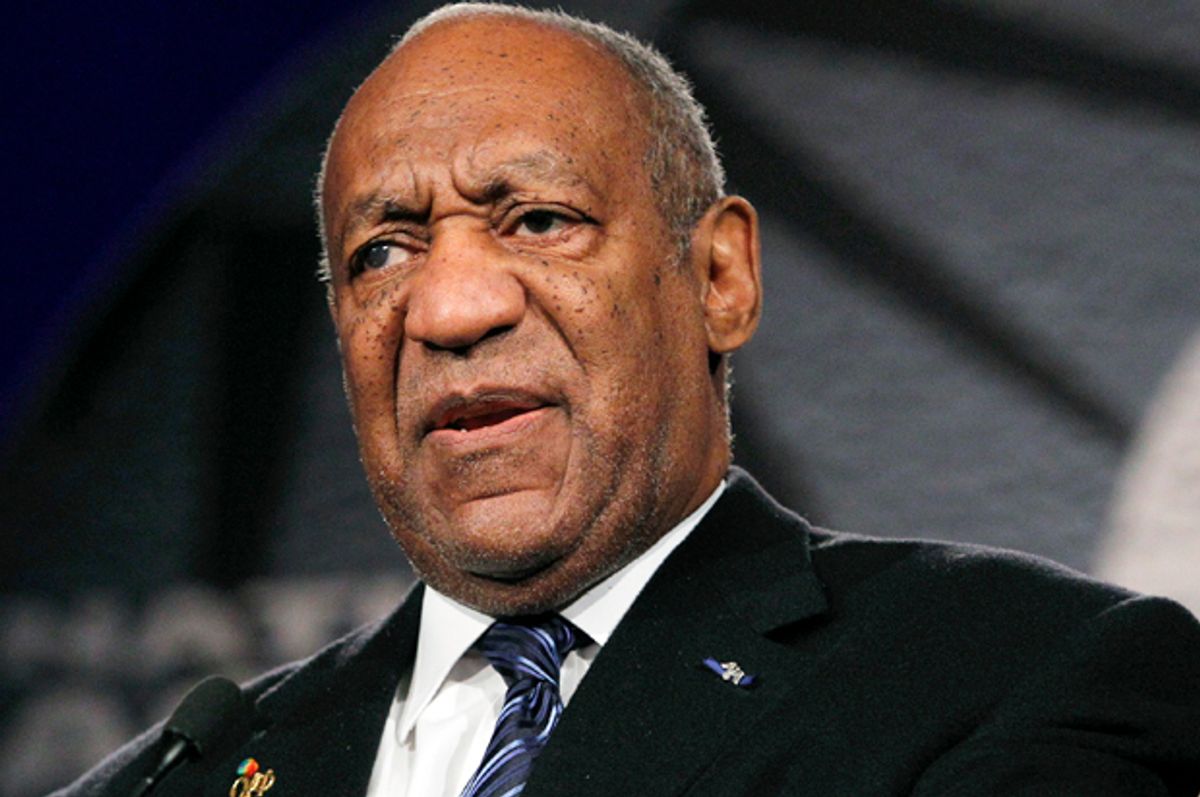

Bill Cosby's media inferno: On journalists reporting justice -- and